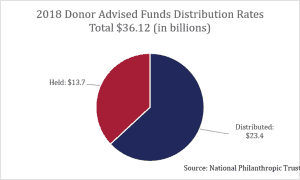

Donor Advised Funds (DAF) attracted an unprecedented surge of 2019 philanthropy. More and more individuals—at all giving levels–used this efficient vehicle to advance their philanthropy last year. When DAFs first gained traction, many nonprofits and prognosticators feared their advent would result in fewer and smaller distributions. However, since the Tax Cuts and Jobs Act of 2017, organizations continue to receive increasing philanthropy. The vehicles through which people make their gifts, however, is shifting. A total of $37.12 billion was given to DAFs in 2018 and approximately $23.42 billion was disbursed to charities.

At TAG, we emphasize staying on top of this giving trend. Understanding how DAFs benefit both your organization and the donor is critical to capitalizing on this trend. When we talk to our clients, we make sure they have the following in mind when dealing with DAFs:

- Come up with a plan! Make sure your organization is prepared to accept gifts that come from Donor Advised Funds. Sit down with your development staff, finance office, and others to develop a protocol for how giving through this vehicle is handled, just like you have a protocol in place to accept all other types of gifts. Update your Gift Acceptance Policy with these guidelines.

- Shout it to the world. Most organizations have a donation page on their website. Make sure you include a Ways to Give section on your website. Include DAFs along with other deferred/planned gifts, real estate, stock, etc. Make sure donors know you welcome gifts from DAFs when considering how to give to your organization.

- Know how they work. Donors may have questions and, while you should point them to their financial advisor, you also should be able to answer basic questions they may have about the topic. Know the difference between a DAF and a family foundation, for example. A DAF is controlled by the entity in which you open the fund. A family foundation is completely controlled by the family or person the family appointed to control it. All of the funds in a DAF have to be given to charity. That is not the case with a family foundation; in some cases, money can be used for operating expenses.

- Community Foundations – Another thing to keep in mind when considering DAFs is that it is not only with banks that a donor can open a donor advised fund, but community foundations can also open DAFs. Develop good relationships with your local community foundation and make sure it’s leadership is aware of your organization and what you do. This can be beneficial when a donor approaches them wanting to donate to a certain sector, but doesn’t have a specific organization in mind.

While it is still too soon to tell, some predictions suggest that donors who have a DAF may be more inclined to make larger gifts than they would if they were giving a donation through a check or credit card. One thing is for sure – this giving vehicle is popular, and momentum appears to remain strong, so familiarizing yourself to maximize DAFs is a win for all!

If your organization is struggling with integrating DAFs or have other development needs, reach out to us at [email protected]. We are happy to guide you through the ever-changing world of fundraising and philanthropy.